We hadn’t left it very long, after the Contractors had departed, to get back into our normal routine, although before that could commence we started with a major clean of the apartment, and I mean a ‘major clean’, every nook and cranny in every room and then Shazza got the guest bedroom, and bathroom, that we had been using, prepared for the impending arrival of our family visitor’s, which to be honest we were both getting quite excited about, considering that we hadn’t expected to see them again this year. The twins celebrated their 10th, but going on 16, birthday’s the day before they come to stay with us, Orla, the youngest would not turn 6 years old until September, although she is 6 going on 16 as well 🤭 ‘But Oh my goodness’ how quick the year’s just seem to have flown by and we are betting that it will not be too long when they reach 18 year’s old (if not before) and will be wanting to come out to stay with us, but without mum and dad, although we probably would not see much of them if that were to happen, what with the nightlife, followed by the days in bed recovering from hangovers as a consequence of late alcohol infused night’s (Been there, done it, got the tee-shirt) 🤭 Although I thought we had got over those days of being parents, sat worrying, watching the clock, listening for the key in the door and then listening for how many footsteps and hushed voices we could hear coming up the stairs, it may be that it all starts again for us, but as Grandparents 😲 Although, it may have one advantage I suppose as the car would probably get a lot more use than it does at present, what with it becoming their personal ‘Uber’ service, ‘Grandad can you give us a lift to……. ‘, or ‘Grandad can you come and pick us up from………..’ and Grandad would say, “Yes, of course’ to his ‘Little Darlings’ 😂

We have also been taking full advantage of our communal swimming pool, getting down their most mornings once the electronic access gate permits, usually around 10:00am, although it can, and does, vary by fifteen minutes on occasions, for no obvious reason 🙄 We generally have the place to ourselves and so can get plenty of exercise swimming sessions done, before the throngs of ‘Little Darlings’ start to arrive usually starting at 12:30pm. However, we will soon be one of those throngs, accompanied by our own ‘Little Darlings’ 😂 Then of course there are our usual shopping trips always with the pre-empted mandatory morning coffee stops and although not very often just recently, the occasional trip out of an evening for a walk and to partake of an evening dose of ‘Anti-Covid Vaccine’ 🍷 sometimes even ‘Dinner’, but that is very much dependent on the temperatures as they rarely drop below 35 degrees(c) much before 9pm 🥵

The ‘Works of Fiction’ have been up to their usual standard of weather predicting, not that they could go too far wrong by forecasting that we would have hot temperatures and full sunshine each and every day, although, the actual accuracy of the temperatures was still more guess work by them than actual certainty, but hey, their 28-32 forecasted degrees was close enough to the actual 32-39 degrees(c) that we have generally had each day, ‘close enough for government work’ I suppose, as the saying goes 🤭 However, what they had also failed to predict, or forecast, was a tremendous Electrical storm. We had been at our English neighbours in the apartment below, they had come out for their usual two week Summer Holiday and had invited us for drinks one evening, which extended into the early hours of the morning 😳 It was 01:00am and we were just making polite noises about leaving when suddenly the whole sky just lit up. To be honest, there was no noise, just frequent bursts of bright light in the sky that lasted for several seconds at a time and continued for a good half an hour, it looked more like the whole of the Northern Coastline of Africa that we can see, was being subject to an Ariel bombing attack. After saying our goodbyes and returning to our own apartment, we both stood on the balcony and looked out at the beautiful light show, but then suddenly, without any warning, the wind increased and the heavy palm leaves on the trees outside our windows commenced their noisy ritualistic thrashing dance, which turned out to be the prelude to the long rumbles of thunder that followed, the heavens opened and the torrential rain fell. We observed that we were not the only one’s stood on our balconies, or looking out of open windows, enjoying this totally unexpected and un-forecasted spectacle. From start to finish it only probably lasted about one hour but it hadn’t provided any relief for us from the hot, sticky and humid night temperatures. However, it is good to see that we are not the only one’s fortunate enough to be enjoying a hot summer as we seem to be sharing it around with the majority of Northern Europe too, although I suspect that there will not be too many homes up there that will be equipped with Air-Con Systems, other than the basic one that is, the opening of all doors and windows, but we hope that you all do enjoy it 🌞😎

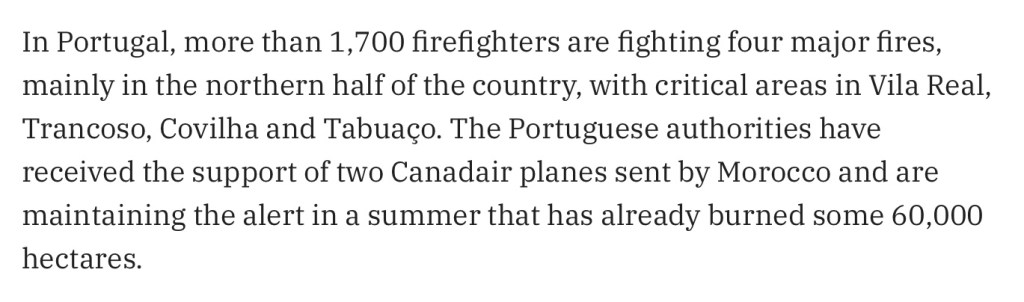

Of course, these hot and very dry Summer’s with their tinder dry conditions also introduce the more devastating impacts with them, and so, the wildfires are very much in abundance again and not just here in Spain, as large areas of Europe are also on fire, Portugal, France, Italy, Greece, Turkey, Albania and even in some parts of the UK. From our balcony we have once again started to see the firefighting seaplanes as they circle around and then descend to fill up with gallons of more seawater, indicating that there is a wildfire somewhere in our vicinity too, but probably further inland, in the higher pine forest clad mountains as we have not received any ‘Local Alerts’ on our mobile phones . However, we are not complacent about it, as it was only 4-5 year’s ago when our whole local neighbourhood were evacuated down to the beach due to a wildfire that encroached to within only a few hundred metres, although we were not in residence at that particular time and then, only within the last couple of year’s, we were stood on our guest room balcony watching the wildfire racing down the mountain towards Estepona, both incidents being just a little too close for comfort 😳

Now not wishing to make light of what is a very serious situation for lots of people right now, I think that that is enough ‘doom and gloom’ in this my own social media publication 😉

In other News………

You may recall that very many rambles ago I mentioned the frustration that I was once again having with Spanish Bureaucracy, this time with the Tax Authority, but at that time I did not go into very much detail, so now I will bring you up to speed with that as their has finally been some progression. I appreciate that this next part of this ramble may not be of any interest to those reader’s who have no interest in moving, on a permanent basis, to Spain, but for those that do, and need to have some advance information on financial matters that could impact on you, in relation to payment of taxes on Pension incomes, then you may find my current personal experience useful. So just who taxes you on those incomes 🤔

First let me re-cap on the UK-Spanish Tax Agreement (although similar arrangements are in force for other Countries). The UK has a ‘No Double Taxation Agreement’ with Spain, (Available to download and read in full on the Internet) this agreement being that the Spanish will not Tax Income that derives from UK Government issued Pensions that are ‘Taxed at Source’ (Quite an important bit of wording as I was to discover), although, you do still have to declare all such incomes on your annual Spanish Tax Returns, as they use the total amount of income you receive to decide which ‘tax bracket’ to put you into, for taxes that may be due on any other incomes that are not covered by the ‘No Double Taxation Agreement’ and, it is worth noting that the Spanish have ‘six tax brackets’, as opposed to only three in the UK, the lowest level here in Spain starting at 24%. Anyway, just for clarity, Shazza and I only have UK Government Pensions, so, after reading the ‘Agreement’ I believed that I would not be liable to pay any ‘Income’ related tax in Spain on any of our Pensions.

So you can imagine my surprise when, after submitting my first annual Spanish Tax return in 2024 (Which was for the 2023 Financial Tax Year) and just to clarify with you that every Individual living ‘permanently’ in the country has to submit an annual tax declaration, even the unemployed. So I was surprised when I got a tax bill. I had to pay the bill before I could challenge it but then obviously spoke to my Tax Lawyer to establish why this was. Without getting too complicated, the thing is that the UK State Pension is not Taxed ‘Directly’ at source, although as all British State Pensioner’s know, the UK Tax Authority (HMRC) do tax you ‘Indirectly’ on your State Pension, as they take the total annual State Pension amount that you receive and include it as part of your total annual income when calculating your annual tax liability 🤷♂️

However, and in full knowledge and agreement with the UK Government, the Spanish interpret your State Pension as one that is not being taxed ‘directly at source’ and so render it liable to Spanish Income Tax, so effectively you are paying Tax in both the UK and Spain on the same Pension, so how on earth can that be, if there is supposed to be this ‘No Double Taxation Agreement’ in force between the two Countries 🤷♂️

Well, as I was to discover, the Agreement is that the UK HMRC have to refund the UK Tax that they have deducted from you in relation to the State Pension and, having actually spoken to someone employed within the UK HMRC, I have established that they do already know this but, if they know and have agreed this process, then my logical question’s are: “Why are the UK HMRC taxing me on my State Pension in the first place ?” and “Why would they make more work for themselves if they already know that they are going to have to refund it anyway ?”🤷♂️ Those of you that, like myself, have a cynical nature, will already have the answer’s to those questions and surprise surprise, it isn’t for your benefit 😉

Now just digressing a little, perhaps one of the most frustrating things about all of this is that we have already established that the UK Tax Authority have already agreed that the ‘Spanish’ will take the tax on our UK issued State Pension, and the UK Tax Authorities know that we are permanent residents here in Spain. As part of the processing of leaving the UK to reside in a new Country, you have to ‘officially’ notify the UK Tax Authority of where you now hold permanent residency, also you have to notify the UK International Pensions Department of the same, additionally, you have to notify your Pension Provider(s). Quite interestingly, it is HMRC that advise your Pension Providers on how much tax to take off your Pensions Gross Amounts, which then begs the question, why do I get letters from the HMRC, every year, advising me that I have ‘Underpaid’ my tax, and by how much but without any explanation as to how I have underpaid, surely that just does not make any sense if they are the one’s who are actually informing my Pension Provider’s on how much to take off me in tax in the first place 🤷♂️ The phrase, ‘I smell a rat’ springs to mind.

Anyway, I digressed a little again didn’t I, so sorry if I have created any confusion, which in my case is not intentional, although I suspect that I may not be the only one creating confusion when it comes to the payment of taxes here, but perhaps in my defence, I am probably the only one that is not creating that confusion deliberately 🤔 As for these official notification procedures when you leave one country to reside in another, well yes, they all do make pretty good sense, in order for the parties involved to be able to communicate with you and also for them to know where they need to send your annual P60’s. So, of course, being the Law Abiding Citizens that we are, we did all of the above once we had our Spanish Residency Permit confirmed and, we double-checked ourselves, on the ‘Official UK Government Gateway’ website, that our tax records reflected our Spanish Residency, we had also received letters of confirmation from our Pension Providers (Including issuers of the State Pension) that they had our new address and contact details.

So, naturally, we had initially assumed, although wrongly as it happened, that ‘all’ of our tax would be deducted and taken by the UK Tax Authorities. So you would have thought, quite reasonably, that the UK HMRC, knowing the agreement between them and the Spanish Tax Authority in respect of tax on the State Pension, would have amended our tax records (A simple case of adjusting your personal tax code) and then that would have involved them not including our State Pension Incomes when assessing our annual UK Tax Liability, it isn’t rocket science. Just to note, after speaking directly myself with HMRC, this change of tax coding is exactly what they will do, but only once they have received, and processed, my Tax Refund application 🤷♂️

So finally, let me get back to the main point, and to just perhaps answer a question that may be on the tip of your tongue, ‘Why did I not address this tax situation in our first year here in Spain ?’, you make a very good point. Well actually I did, and it was a telephone call with the UK HMRC where I discovered that as part of the ‘six page’ application to apply for my tax refund, I needed to obtain, from the Spanish Tax Authority, a ‘Residencia Fiscal En Espana Convenio’, which is quite simply, a single sided A4 sized piece of paper, a Certificate, that simply confirms that I am a ‘Tax Resident in Spain’. However, this is where the rather illogical Spanish Bureaucracy once again comes to the fore.

Now bear in mind that to become a ‘legal’ resident in Spain in the first place you first have to jump through a whole host of official administrative hoops, and part with even more money along the way, before you can be issued with your Spanish residency card. Additionally, as a UK State Pensioner, in order to get reciprocal ‘Free State Healthcare’ in Spain, you have to obtain a Spanish Health Card, which can only be issued to ‘Permanent Residents’, so yes, we also have the officially issued Spanish Health Cards. Also, in order to obtain a ‘Spanish Driving Licence’ you have to be a Spanish Resident and relinquish your UK Driving Licence, take medical and other associated driving tests (Albeit, not actual driving lessons or driving test ‘per se’), and you have to be registered on the Padron (With the Local Town Hall) as a Permanent Resident. Now also bear in mind that I had already submitted, and paid, my first annual Spanish Income Tax bill, which I think is reasonable to suggest is something that you would not ‘choose’ to do voluntarily if you were not a Permanent Resident 🤷♂️ So I was completely gobsmacked when I asked my Tax Consultant to apply on my behalf to the Spanish Tax Authority to obtain this ‘Tax Certificate’, only to be told that I actually had to prove that I officially lived in Spain 😤😤😤 The process for me, having to prove that I did indeed live here permanently was to be yet another long administrative process. Now coincidentally, it was just after having paid my first Spanish tax bill and I started to chase this ‘Tax Certificate’, only to be told that actually ‘paying my taxes’ here in Spain was not proof that I actually lived here 🤷♂️ Somebody was having a laugh at my expense, why the bloody hell would I choose to pay ‘Income’ tax in Spain if I did not actually live here 😤😤 Also, at the same time it coincided with the long administrative process we needed to go through to renew our ‘Residency Permits’, so to be honest, I had quite enough administrative processes going on already so decided to put that ‘Tax Certificate’ application on the back burner. Now I had also been in communication with the UK Tax Authority, who advised me that even once I had submitted my refund application it would take ‘at least’ six months to process it, probably longer as they were short-staffed and had a back log 😲 So this then became not so much of a time critical procedure, well not as far as either of the Tax Authorities in Spain or the UK were concerned, I mean it wasn’t actually impacting on them that I was continuing to have to pay tax twice, each and every month, on the same Pension income. That is when they told me that once the refund application was processed, not only would I get a refund for the tax already paid since 2023, but they, the Tax Authority in the UK, would finally change my tax code to prevent me from paying double taxation on my State Pension in future years. Just to add to the illogical and completely frustrating situation, I started the process on this the Spanish side, to apply for the ‘Tax Certificate’, at the end of May, only to be advised that it would be better to wait until I had paid my 2024 tax bill, the payment being taken directly from my Bank Account by the Spanish Tax Authority, but not until the 30th June 😳 Hang on just a darned gone minute, I thought that they had informed me that payment of my 2023 Tax Bill was not proof that I lived in Spain, so if that was the case, why on earth did I need to have to wait until I had paid my 2024 tax bill ? The only answer that I received, ‘That’s just the way they do things here in Spain’ 🤷♂️ There are times when it is seriously hard to just bite your lip and say nothing and I, on occasions like this, find myself thinking, ‘If It Wasn’t For The Bureaucracy’ this could be almost the perfect country to live 🤷♂️ Well, if you rule out the Wildfires in the Summer and the Floods in the Winter 😂

However, the good news is that finally, on Friday 8th August, after ten long weeks from first starting this request to obtain the Tax Certificate from the Spanish Authorities, I received the illusive document required to progress with the UK side of things 🥳🥳🥳 Funny old thing though, on a local Expat Social Media site I was casually reading, this very subject came up as a question from somebody new to the area, they were informed that normally it would only take two weeks to get the said Certificate 🤷♂️ Perhaps I need to start looking for a new Tax Representative for next year 🤔 Anyway, I posted my six page refund application form, and accompanying Tax Certificate, sent by Recorded Delivery (Carta Certificada) of course, on the 12th August, well I wasn’t about to take any chances of HMRC saying that they hadn’t received it, I will receive an Email from ‘Correos’ (Spanish Post Office) confirming the date and time that it was delivered and I know from experience, that even ordinary first class mail usually gets to, and from, the UK within seven days so, all things being equal, which they very rarely are not, I may just get this sorted before the start of the new UK Tax Year, in ‘April 2026’ , but no, I will not hold my breath in anticipation 🙄

Anyway, yet another Bureaucratic hurdle overcome and with the knowledge that, other than willing to take the tax from my pension income each year, the Spanish Tax Authority have also, finally, acknowledged that ‘Yes’, I do actually live here 😂 So, I will now end this ramble here because, in just about four hour’s time, our family visitors will arrive on our doorstep and our week of fun, and chaos, will commence 🤗🤗

Until my next ramble,

Hasta Luego mi Amigos, La Vida Es Buena

Leave a reply to Eric and Shazza Cancel reply