We had returned home from our Granada trip to some much awaited good news, and although the drought conditions here in Andalusia are still very much in place, our area of the Malaga Province has now been downgraded to ‘Moderate’, as opposed to the ‘Severe’ conditions that we had previously been under. This is as a consequence of the two storms that we had back in March, both of which had provided our Province with some much needed rainfall to start to refill the Embalces, although they are still not to 100% of their capacities and with the hot Summer months creating some loss through evaporation, and with the additional demand on the water supply, with the increase in population over the busy summer tourist season, these current water capacities will again start to reduce, although the authorities have stated that they estimate that we currently have sufficient to last for 8 months. So, the good news for us came in two parts, first, with effect from 1st June, our personal domestic water usage allowance has been raised again, from what had been an allowance of only 160 Litres each per day, to then, very recently, an increase up to 200 Litres each per day, however, as from 1st June, that will now be increased yet again to a new ‘daily’ individual personal usage allowance of 225 Litres 🤗. To be completely honest with you, Shazza and I have not really been affected too much, even with the 160 Litre limitation, we just had to change our water usage habits slightly and, in reality, even with this increased usage allowance, we will still continue to try and reduce our water usage (Wastage) wherever possible, although, we cannot deny that it is now very nice, especially as the temperatures are now also continuing to rise on a daily basis, that we can now take a shower on a daily basis again, instead of just every other day. The second piece of good news for us, although in all honesty it does tend to pale a little bit into insignificance against the very much more important rise in the ‘domestic’ water usage allowance, but, also effective from 1st June, we will be permitted to once again use our private communal swimming pools, so we are really looking forward to daily life beginning to start to smell a little bit sweeter again 😂

Although we did not know about it beforehand, a week after we had returned home from our mini-break, during the weekend, there was an ‘International Families Day’ event being held at the ‘Castillon’ (Castle) in the former fishing village. Previous events of this nature had been relatively small affairs, but the event has grown so much in popularity over the last couple of years, that it now occupies a much larger area, on the public road that encircles the castle and into the adjacent public park. I guess that it reflects the different Nationalities that now reside in this area, it came as a bit of a surprise to us, we were obviously aware of the large European, American and Canadian Expat presence, but we were certainly not really that aware of the large presence from the much wider Asian and South American countries. We certainly cannot recall us ever attending any of these events over the last nine years or so, which is surprising as Shazza and I like these type of local community events. Perhaps they were held during the ninety-day ‘Schengen Shuffle’ periods when we had to exit the EU 🤔 Well at least that is now no longer an issue for us.

This International Families Event continued over two full days, and nights, with ‘live’ bands performing well into the early hours, fortunately, whilst we live only a few minutes drive away from where it is held, it is also far enough away for us not to be disturbed by the night’s revelries 😉

After our mini-break and doing our own touristy stuff in Granada, once back at home we effortlessly slipped back into what are now just our ‘normal’ more relaxed daily routines. However, although we had only been away for a few days, we noticed a bit of a change when we went on our first daily walk along the seafront promenade and into the town. All the beachfront Chiringuitos were now open, with their beach frontages and sun loungers looking pretty busy with customers, the wooden boardwalks, leading from the promenade down onto the beach had been laid, to stop people from burning their bare feet on the scorching sand when making their way down to the sea, but more noticeable were the amount of people actually on the beach with their sun chairs, sun umbrellas, cool boxes and paddle-boards and the towns seafront Cafe’s were certainly far busier than they had been, so although the school half term holidays had not yet officially commenced, it looked as if ‘It Was All Beginning To Kick Off’ now, the tourist season it would seem has arrived, albeit a couple of weeks earlier than anticipated, but it is nice to see the place starting to come alive again, we may not like crowds but boy does it give us plenty of people watching opportunities 😁

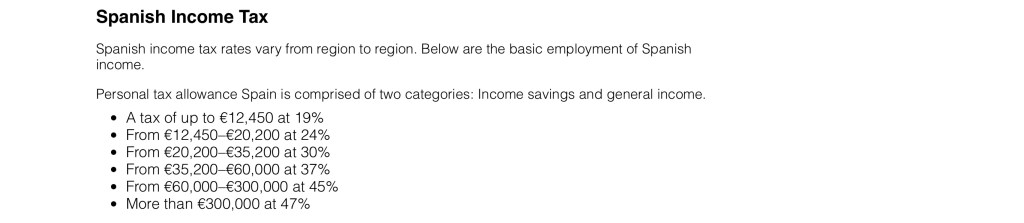

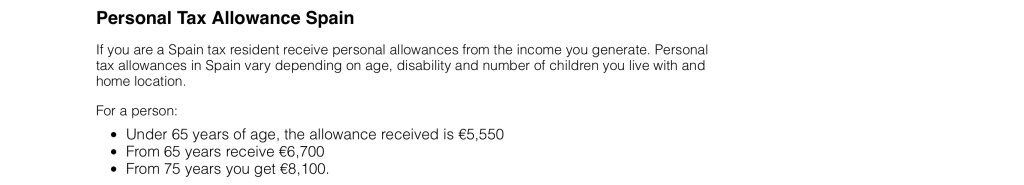

I had thought that back in February, when I had submitted our Income Tax related forms to our Tax Consultants, that that was it, in respect of the payment of our Income tax for the last 2023 Financial Year, and that we would just have to wait to be advised of the amount of the tax bill. So I was a little surprised when I recently received another Email from our Tax Consultant asking me to submit even more Tax Forms 🤔 I obviously questioned this, only to be informed that the financial information that I had previously submitted was just to enable us to be formally registered, as individuals, with the Spanish Tax Authorities who would then allocate and issue us with our Individual Tax Reference Numbers (in reality those reference numbers would be sent to our Tax Consultants who do all the formal stuff on our behalf). Fortunately, this registration process and procedure only has to be done the once and not annually. However, now that we are officially tax residents, in May each year we are required to submit our formal Income Tax Declaration Forms, for all our incomes received over the previous Fiscal Year, in Spain the Fiscal Year runs from 1st January-31st December, the tax due has to be paid in June, failure to do so results in a fine, although, if you wish, you can elect to make split payments, 60% in June and 40% in November. Now I cannot go into the complexities of the Spanish Taxation System, as I am not qualified to provide such advice, and especially as individuals will have their own income sources and financial circumstances, but I will offer this one piece of advice, do your research before you elect to make the move here, as the tax system may be very different to what it is in your own home country and, if you do choose to come and live here, unless you are professionally qualified, it is a good idea to employ the services of a ‘reputable’ Tax Professional to submit your annual tax declarations on your behalf, they know the in’s and out’s of the Spanish Taxation System and will also be able to advise on wether it is more financially advantageous for you to submit either ‘Individual’ or ‘Joint’ Tax Returns. However, below I will provide some current basic tax information just to give you some idea, but this is all readily available on-line by doing a search on ‘Google’ 👍

The other thing to be aware of is that ‘All’ income you receive Globally is taxable in Spain, unless the country you originate from has a ‘No Double Taxation Agreement’ in force with Spain. This means that ‘some’ Incomes that you receive may be ‘Exempt’ from paying Spanish Tax e.g. Government Issued Pensions (Military, Civil Service, Police, Fire Service, some Teacher’s Pensions) which, under the agreement, remain taxed at source, unlike the majority of ‘Private’ Pensions, which ‘generally’ do not fall under the exemptions of the ‘No Double Taxation Agreement’. However, and particularly relevant to know for individuals coming from the UK, is that the UK issued State Pension IS subject to being taxed in Spain, so in this instance you have to apply retrospectively to UK HMRC, for a refund of the tax paid to the Spanish Tax Authorities (There is a form on the UK Government website to enable you to do this), also note that there are Tax Professionals here in Spain who can assist with this procedure. Also worth noting are two other things, first, ‘everyone’ who is ‘registered’ as a ‘Tax Resident’ of Spain, has to submit an annual tax return, even if that is a ‘Nil’ return e.g. Dependents under pension age who may have no independent personal income sources themselves (Spouses or Partners), secondly, even if some incomes are ‘Exempt’ from Spanish Tax (Under the ‘No Double Taxation Agreement), they still have to be declared on the Spanish Tax Forms.

Now this may all sound very complicated and may even deter you wanting to come and live in Spain, but provided you are aware of the tax requirements in Spain in relation to your own Financial circumstances, especially what incomes that you have that are, or are not, exempt from Spanish Tax, then it is not as complicated as it may at first sound, once you get your head around it. As you will probably imagine, myself and my OCD buddy have always maintained detailed personal financial records, even when we lived in the UK, so I had all the information required to complete the tax declarations for both myself and Shazza, including our latest annual P60’s and any other official financial administrative records. So, within only a couple of days of submitting this information to our Tax Consultant, we received confirmation of what this year’s tax bill would be, we were pleasantly surprised, and happy in the knowledge that we will get ‘some’ of this tax back, refunded from the UK HMRC, albeit that involves even more form filling, although we strongly suspect that getting money back from the UK Tax Authorities, at the speed they deal with refunds, may actually take some time to receive back 🙄

The only other commitment that we had to do this month was to get our car serviced, or so we believed !! So back in January I had pre-booked a service on-line, through the main KIA Espana website, to have my car serviced at the ‘Malaga’ Dealership, I received a confirmation Email that this had been booked. I had selected the Malaga dealership because I had used them on two previous occasions when I had issues with my car and they proved to be extremely helpful and efficient, regular readers of my rambles will already be aware of those issues. However, the dealership is a one hour drive away so it would entail and early start to get the car delivered to them in the morning, and then having to spend the best part of the day waiting for it to be finished. Fortunately, it was only an easy thirty minute walk from the dealership to a large shopping mall at ‘Plaza Mayor’, which has recently been extended and now also accommodates a large ‘McArthur Glen’ retail outlet, so although neither of us are really shoppers, at least we could pass our time whilst we waited for the call to tell us our car was ready to collect.

When we arrived we were greeted by a very friendly male receptionist who spoke a reasonable level of English, certainly much more fluent than my Spanish, and he proceeded to check the car in. He noticed that we had already had two Services conducted, both in the UK, one in 2022, after the first year of ownership, and another in 2023, he queried as to why we had had two services conducted, when they are only required every 20,000 miles or at two year intervals, whichever came first, so we should not have had the first service until 2023 and the second would not have been due until 2025 🤔 Now in hindsight I should already have known this, it was the same principle for the Motorhome, in my defence I can only think that things had got confused with the major engine issue that we had with the car in the first year that we had it and, irritatingly, the KIA Dealership in Doncaster had not informed us when we took the car in, for what we thought was the first service due date, in May 2022, that in fact it was not due a service until 2023, but neither did they tell us this when we took it for its second service the following year that it was now not due a service until May 2025 😡 It isn’t as if they were making any money from us, as under the 7 Year Warranty, the first two services were ‘Free’ 🤷♂️

Anyway, ‘Luis’ the dealership service receptionist in Malaga, did tell me that the car did not require another routine service until next year, which was a bit of a bonus as I had budgeted for it being done this year, and so, to my complete joy, I had now unexpectedly saved some money, or at least that had been my initial happy thought until a couple of hours later that day……………….🙄 There were still a couple of Administrative and Technical things that I needed to have done with the car, now that it has been imported into and registered in Spain, and a possible technical issue that I needed them to check out, which would involve them putting it on their diagnostics machine. So we still needed to leave the car with them and then wait until he called us to say that it was ready to collect, which he informed us could be anytime up to 4pm. However, we had planned for a full day out and had nowhere else we needed to be 🤷♂️

When we had left the car in this dealership, on the last occasion we were here, we discovered a nice little Cafe, and conveniently it was on our walking route to ‘Plaza Mayor’, we decided to stop there again for a Coffee, and okay, yes I confess, we also had a Tostado with it, but come on now, it would have been really disrespectful not to 🤭 It seems a little pointless telling you that it was yet again another nice warm day, however, it was not as hot as we had anticipated that it was going to be at only around 23 degrees(c), over the last couple of days in our local town, just a little further down the coastline, the temperatures had been a searingly hot and humid 28 degrees(c) 🥵 so we had rather expected much of the same here.

As I may have mentioned a few times in these ramblings, neither of us are shoppers but, for our upcoming large family three day event in Austria in August, on the second day, the Saturday, it is a little more formal, a smart, but casual, sort of affair, so whilst Shazza had already got her dress sorted, she of course needed some new shoes, and of course a matching handbag, to go with her outfit 🙄 However, I cannot put all the focus of attention on her for all the additional expenditure, but I also can neither confirm, or deny, that I too ‘may’ also have taken the opportunity to make a ‘few’ clothing and footwear purchases myself, albeit in truth mine were not really absolutely ‘necessary’ purchases for the Austria trip 🤭 but the long and short of it is, between the pair of us, on this particular day, we spent very much more than what the actual car service would have cost us. I think the really scary thing about it though was, especially for a usually much more very thrifty Yorkshireman, we had both agreed that we had actually enjoyed this rare retail therapy session and, if the truth be known, perhaps just a little bit too much 😲 Fortunately, two hours earlier than anticipated, we were saved from any further decline to our rapidly diminishing bank balance, by the phone call from the garage telling us that our car was ready for collection. However, on our way home we also called in at another large shopping mall, the ‘Miramar’ at Fuengirola, only because that is where there was a ‘Holland & Barrett’ herbal health type store which sold the Herbal Teas that Shazza likes, and as we rarely go there she always like to buy a batch of them to last a couple of months. We had planned to have a proper lunch whilst at ‘Plaza Mayor’ but, because of the earlier than anticipated collection of the car, that lunch did not materialise and so now we were both beginning to feel a little hungry, so we decided that whilst at the Fuengirola mall we would have a late lunch, or as it turned out, an early dinner, and settled for a very nice Italian restaurant. It had actually turned out to be a really enjoyable day out, not a completely wasted trip either, in respect of the car not requiring a service, as the dealership did now have us registered on their database with all the Spanish registration details, including our Spanish Address and Telephone numbers and, the Diagnostics checks that they had conducted, had revealed no issues whatsoever with the car, which was a relief, as when it went through its ITV Test (equivalent of MOT), as part of the importation process, they had said that their was an error code which related to a serious fault with the Engine Compression, albeit no warning lights had come up on the dashboard display and I certainly had not experienced any lack of performance when driving the car, but these sort of things tend to weigh on your mind a bit, but not any longer. The KIA dealership made no charge for the time spent on conducting these diagnostic checks and also, when we went to collect the car, they had offered to put it through a car wash before we drove it away, free of charge and a normal part of their customer service, but as we had put it through a car wash the previous day we declined their generous offer.

We have no other mini-breaks, or day trips, planned for the coming weeks, although that of course does not guarantee that Shazza will not spring one of her spontaneous one’s on me 😂 We have no other ‘known’ commitments now until the middle of June, we are just awaiting confirmation that our Residency Permit renewal applications have been approved, and an appointment date to go and collect our new TIE Residency Cards, however, we know that they will not issue them before 13th June when our current one’s expire. But we are quite excited at the prospect of not having to go through this residency permit renewal process again for a further two years, in June 2026.

So, until my next ramble, wherever you may be, if in the Northern hemisphere, enjoy the start of your Summer, or if in the Southern hemisphere, get wrapped up for the commencement of your Winter.

Hasta Luego mi Amigos, “La Vida Es Buena”

Leave a reply to debsk31 Cancel reply